Hi, I’m Maddie Brooks, a licensed insurance agent based in Manchester, New Hampshire. For the past seven years, I’ve helped Granite Staters from Nashua to Keene find affordable car insurance, even when money is tight and income is inconsistent.

Many of my clients receive SNAP benefits and rely on EBT cards to help manage daily costs. I’ve worked with single parents, college students, seniors, and part-time workers — all of whom need legal insurance coverage to keep their lives moving forward.

Although New Hampshire does not offer an official EBT discount on car insurance, there are insurance providers that offer low-income-friendly options. These include weekly billing, no-deposit policies, and approval based on SNAP, SSI, or gig income — not just traditional full-time jobs.

Let me walk you through how to get cheap EBT auto insurance in New Hampshire without overpaying or dealing with unnecessary rejections.

📘 Does New Hampshire Offer an EBT Car Insurance Discount?

No. New Hampshire does not have a government-run program that provides a direct car insurance discount to SNAP recipients. Also, your EBT card cannot be used to pay insurance premiums.

However, many private insurance carriers in the state offer:

- Liability-only coverage for those who own older cars

- Flexible billing cycles that align with SNAP deposit dates

- Non-owner policies for people who borrow vehicles

- No or low-down-payment options

- Approval for clients with non-traditional income sources

These EBT-friendly plans help thousands of low-income residents stay insured and street legal every year.

🧾 5 EBT-Friendly Insurance Carriers in New Hampshire

Here are five carriers I frequently recommend to SNAP recipients in New Hampshire:

| Insurance Company | Why It’s SNAP-Friendly | Avg. Monthly Rate (Liability) | Billing Flexibility |

|---|---|---|---|

| SafeAuto | No deposit, accepts SNAP/SSI as income | $80/month | Weekly/monthly billing |

| Dairyland Auto | No credit required, great for older vehicles | $82/month | Bi-weekly billing available |

| The General | Works well with drivers who had prior lapses | $85/month | Low up-front cost, flexible dates |

| Progressive Snapshot | Ideal for low-mileage drivers | $78/month | Up to 30% off using app 📱 |

| National General | Accepts SNAP/SSI, great for renters bundling | $79/month | Flexible billing, bundling options |

💡 All rates reflect liability-only insurance for drivers with older vehicles (2008–2015), average records, and EBT/SNAP-based income.

👥 Insurance Professional Quotes from Across New Hampshire

🔹 Nina Garrison – Nashua, NH

“We helped a SNAP recipient driving a 2010 Toyota Corolla get SafeAuto coverage for $79/month. She paid no deposit and chose weekly billing to match her EBT schedule.”

🔹 Paul Riley – Concord, NH

“Dairyland is a great choice for folks with low or no credit. One of our SNAP clients got liability-only on a 2009 Honda CR-V for $82/month, paying every two weeks.”

🔹 Lauren Mendel – Manchester, NH

“A client using Progressive Snapshot only drives three days a week. After 45 days, her rate dropped from $78 to $59/month. She’s on SNAP, and the savings made a real difference.”

💡 6 Tips for SNAP Recipients Getting Auto Insurance in New Hampshire

- Understand the Unique NH Law — Insurance Isn’t Mandatory, But Still Smart

New Hampshire is one of the only states that doesn’t legally require car insurance, but you’re still financially responsible for any accident you cause. Liability coverage is highly recommended. ✅ - Liability-Only Is a Good Fit for Paid-Off Cars

If your car isn’t financed and is worth less than $4,000, liability-only coverage is the most cost-effective and legal choice. - Save with Telematics If You Drive Less

Using an app like Progressive Snapshot can lower your rate by up to 30% if you drive safely and under 7,500 miles/year. 📉📱 - Pick Billing That Matches Your SNAP Deposit Cycle

Carriers like SafeAuto and Dairyland let you schedule weekly or bi-weekly payments that line up with your EBT load dates. 📆 - Ask About Non-Owner Coverage If You Don’t Own a Car

Borrow someone’s car regularly? A non-owner policy keeps you covered for as little as $40–$55/month. 🔁 - Be Honest About Using SNAP or SSI

Most EBT-friendly carriers accept alternative income verification, and won’t penalize you for not having a W-2 or traditional paycheck. 🤝

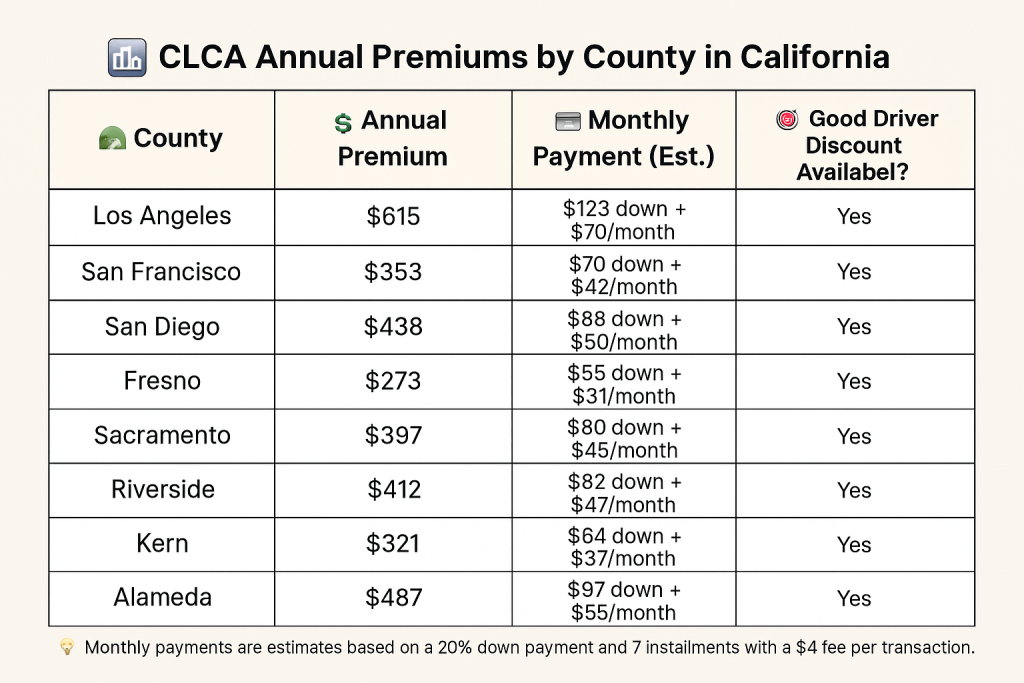

📊 Estimated Monthly Liability Rates – EBT Clients in New Hampshire Cities

Here’s a snapshot of what EBT recipients might pay for liability-only insurance across the state:

| City | Avg. Monthly Rate | Best Carrier |

|---|---|---|

| Manchester | $80/month | SafeAuto |

| Nashua | $79/month | Progressive Snapshot |

| Concord | $81/month | Dairyland Auto |

| Dover | $78/month | National General |

| Keene | $77/month | The General |

📍 In smaller towns like Claremont, Littleton, or Laconia, rates can be $5–$10/month lower due to less traffic and fewer claims.

❓ EBT Auto Insurance FAQs – New Hampshire Edition

1. Can I pay for auto insurance with my EBT card?

No. EBT cards are restricted to food-related purchases. However, using SNAP for groceries may free up funds to pay for car insurance separately.

2. Is there a government discount on car insurance for EBT cardholders in NH?

No official discount exists. But private insurers like SafeAuto, Dairyland, and The General offer low-cost plans that accept SNAP-based income.

3. What if I don’t have a job but receive SNAP or SSI — can I still get covered?

Yes. Most carriers listed above accept SNAP, SSI, and informal income sources when evaluating your policy eligibility.

4. Do I legally need car insurance in New Hampshire?

No — New Hampshire is the only state that doesn’t require insurance by default, but if you cause an accident and aren’t insured, the financial consequences can be extreme.

5. What happens if I cause an accident with no insurance?

You could face major out-of-pocket costs, lawsuits, license suspension, and be required to file an SR-22 for future coverage.

6. Do I need full coverage on a 10-year-old car?

Not usually. If your car is paid off and low in value, liability-only coverage is the smarter and cheaper option.

🧾 What Makes a Car Insurance Policy EBT-Friendly in New Hampshire?

| Feature | Why It’s Ideal for SNAP Recipients |

|---|---|

| ✅ No or low down payment | Avoids up-front financial barriers |

| ✅ Weekly or bi-weekly billing | Matches SNAP/EBT deposit cycles |

| ✅ Accepts SNAP/SSI/gig income | No job or W-2 required |

| ✅ Liability & non-owner policies | Legal and cost-effective |

| ✅ Usage-based discounts | Great for low-mileage rural drivers |

💬 From Maddie: Let Me Help You Get Covered Without the Hassle

I’ve helped dozens of New Hampshire drivers on SNAP benefits get the coverage they need — without judgment and without massive upfront payments. If you’re living on EBT income, it doesn’t mean you have to go uninsured or unprotected.

📲 Send me your ZIP, your vehicle info, and how often you drive. I’ll build you a custom, EBT-friendly quote with no deposit and flexible billing — fast, fair, and totally legal.