If you’re currently using an EBT card—whether it’s for SNAP, TANF, or another public assistance program—I want to start by saying this:

You are doing what you need to do to support yourself and your family. And that’s something to be proud of.

As a hardship counselor, I work every day with individuals and families who are navigating tough financial seasons. One of the most common concerns I hear is:

“How am I supposed to afford car insurance when I’m on EBT?”

You’re not alone. And while car insurance is a legal requirement in almost every state, the good news is: there are options available for EBT card holders to reduce costs, access special programs, and stay protected on the road.

Let’s walk through what’s available, how to qualify, and where to get help—because you do have choices. 💪

🚘 Why EBT Card Holders Still Need Car Insurance

First things first—let’s talk about why keeping car insurance matters, even when money is tight:

It’s required by law. Driving without it can lead to tickets, fines, and even license suspension.

It protects your financial future. If you’re in an accident, the bills can be devastating without coverage.

It helps you keep your job. Many people rely on a car to get to work, school, doctor visits, or childcare.

Even basic liability insurance can give you a legal and financial safety net, and help you move forward with more peace of mind.

💳 Is There Car Insurance Specifically for EBT Card Holders?

Here’s the truth: most big-name insurance companies don’t offer an official “EBT discount.” But that doesn’t mean you’re out of luck.

There are programs and discounts available for low-income drivers, many of which accept EBT enrollment as part of income verification.

What to Look For:

| Program or Discount | Accepts EBT as Proof? | Who It Helps |

|---|---|---|

| State Low-Income Auto Insurance | ✅ Yes | Residents in select states (like CA, NJ) |

| Local nonprofit referrals | ✅ Often | Helps connect you to insurers who understand hardship |

| Usage-based insurance | ✅ Indirectly | Rewards safe, low-mileage drivers (many on EBT drive less) |

| Payment plan flexibility | ✅ Yes | Many companies offer low-down payment plans |

| Insurance brokers & agents | ✅ Yes | Can advocate on your behalf for hardship rates |

💡 Counselor Tip: It’s not always about the EBT card itself—it’s about your household income and your willingness to advocate for available support.

🏆 Top Options for Affordable Car Insurance If You’re on EBT

While you may need to call and ask specific questions, these insurance providers are known to work well with lower-income households or offer flexible, affordable plans:

| Company 🏢 | Best For | EBT Consideration |

|---|---|---|

| Dairyland Insurance | Drivers with little or no insurance history | ✅ Often accepts proof of public assistance |

| Progressive | Safe drivers or those willing to try telematics | ✅ Ask about hardship/payment plan options |

| GEICO | Low-cost liability coverage | ✅ Local agents may assist based on income |

| Infinity Auto | Non-standard and high-risk drivers | ✅ Good for drivers with lapses or tough credit |

| Local brokers | Finding lesser-known insurers | ✅ Many specialize in low-income clients |

🚗 Counselor Note: Independent brokers often have access to regional carriers who don’t advertise online but offer low monthly payments for qualifying drivers.

📍 State-Sponsored Insurance Programs That Help EBT Users

Some states go a step further and offer official low-income car insurance programs, which do accept EBT and other benefit documents to verify eligibility.

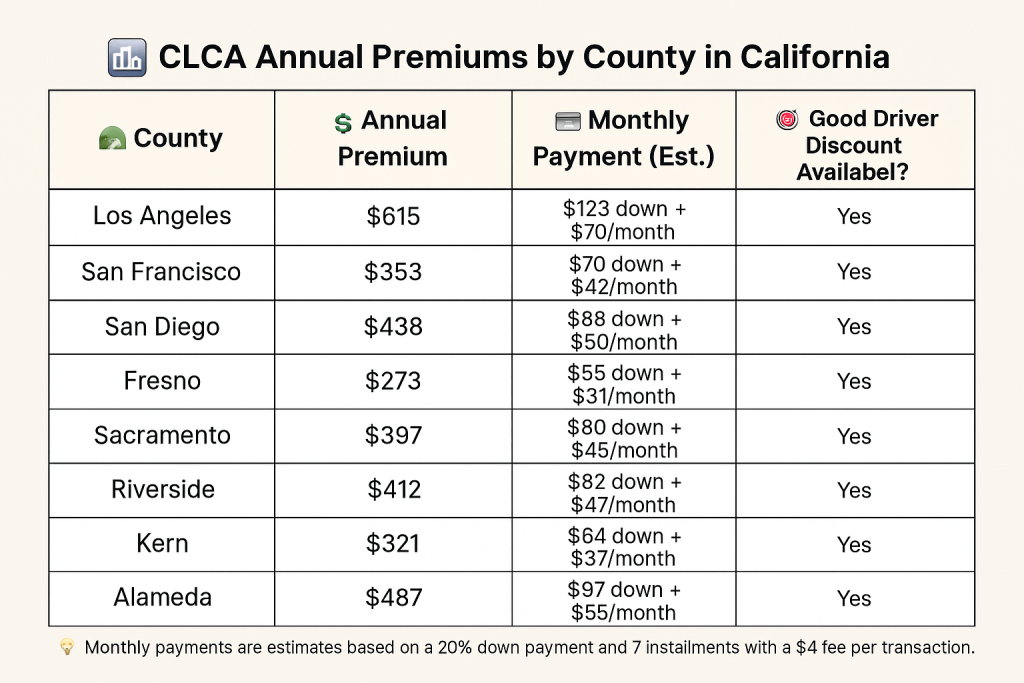

🟦 California – CLCA (California Low Cost Auto Insurance)

| Feature | Info |

|---|---|

| Monthly Cost | As low as $20–$50/month |

| Requirements | Low-income, good driving record, vehicle worth < $25,000 |

| EBT Accepted? | ✅ Yes, as proof of income |

| Website | mylowcostauto.com |

🟦 New Jersey – SAIP (Special Automobile Insurance Policy)

| Feature | Info |

|---|---|

| Yearly Cost | $365/year or $360 paid in full |

| Requirements | Must have Medicaid with hospitalization |

| EBT Accepted? | ✅ Indirectly (used to verify income) |

| Website | state.nj.us/dobi/saip |

🌍 Other states like Hawaii, New York, and Washington have assistance programs through Medicaid or social services that can connect EBT recipients to low-cost options—just ask your local agency or nonprofit support office.

📊 How Much Could You Save?

Here’s a real-world comparison of what car insurance might cost with vs. without low-income support:

| Scenario | Regular Policy | Low-Income Program | Monthly Savings 💵 |

|---|---|---|---|

| Single mom in Fresno, CA | $115/month | $32/month (CLCA) | $83 saved |

| Retired veteran in Trenton, NJ | $90/month | $30/month (SAIP) | $60 saved |

| EBT cardholder in Houston, TX | $130/month | $85/month via broker | $45 saved |

These savings add up—$500 to $1,000 per year, which can go straight back into your essentials: groceries, rent, or savings.

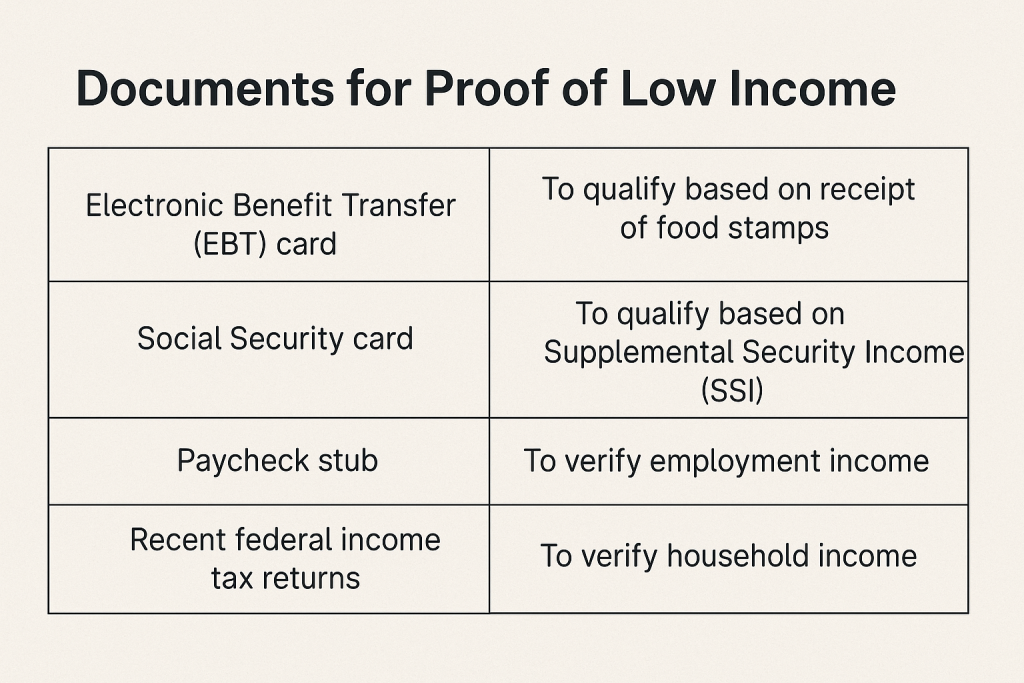

✅ What Documents to Prepare (EBT-Friendly)

When applying for low-cost car insurance, having the right paperwork ready can speed up the process and prove your eligibility.

| Document 📄 | Why It Helps |

|---|---|

| EBT Award Letter | Verifies enrollment in a public assistance program |

| TANF / SSI Letter | Shows household financial status |

| Paystubs (if applicable) | Verifies low-income eligibility |

| SNAP Card (EBT) | Can be used to verify identity and support need |

| Proof of Address | Required by insurers and state programs |

| Vehicle Registration & VIN | Needed for all quotes |

📎 Pro Tip: If you receive multiple benefits (like Medicaid + SNAP), bring them all—some programs base eligibility on the full picture of your household income.

💬 Final Thoughts from a Hardship Counselor Who Cares

If you’re holding an EBT card and trying to figure out how to afford car insurance, know this:

👉 You’re not alone.

👉 You have options—even if they’re not always obvious.

👉 And asking for help is not weakness—it’s strength.

Whether you’re between jobs, raising a family on your own, or simply trying to make ends meet—there is support out there. From state-funded programs to flexible insurers to brokers who genuinely want to help—there is a path forward that keeps you legal, protected, and empowered.

Key Takeaways:

Car insurance is required, but you don’t have to pay full price.

EBT use may qualify you for state or income-based programs.

Always ask insurers or brokers if they have hardship or low-income options.

Keep documentation handy—it can unlock huge savings.

If you’re unsure where to start, reach out to a counselor, nonprofit, or local support agency.

Common Concerns and Answers:

1. Can EBT card holders get car insurance?

Yes, EBT card holders can absolutely get car insurance. Having an EBT card does not disqualify you from purchasing car insurance.

2. Will having an EBT card affect my car insurance rates?

Having an EBT card should not impact your car insurance rates. Insurance companies typically base rates on factors such as driving record, age, and type of vehicle.

3. Can I use my EBT card to pay for car insurance?

Unfortunately, EBT cards cannot be used to pay for car insurance. You will need to use a different form of payment, such as a credit card or bank account.

4. Will my EBT benefits be affected if I have car insurance?

Having car insurance should not affect your EBT benefits. These are separate programs with different eligibility requirements.

5. Are there any discounts available for EBT card holders on car insurance?

Some insurance companies may offer discounts for low-income individuals, which could potentially benefit EBT card holders. It is worth exploring different insurance providers to see what discounts they may offer.

6. Can EBT card holders qualify for state assistance programs for car insurance?

Some states offer assistance programs for low-income individuals to help with car insurance costs. EBT card holders may qualify for these programs, depending on their income level.

7. Will my EBT card be considered a form of income by insurance companies?

Insurance companies typically do not consider EBT benefits as income when determining car insurance rates. They will focus on other factors such as driving history and credit score.

8. Can EBT card holders get full coverage car insurance?

Yes, EBT card holders can choose to purchase full coverage car insurance if they wish. The type of coverage you choose will depend on your individual needs and budget.

9. Are there specific insurance companies that cater to EBT card holders?

While there are no specific insurance companies exclusively for EBT card holders, many insurance providers offer affordable options for low-income individuals.

10. Will my EBT card affect my ability to file a claim with my insurance company?

Having an EBT card should not impact your ability to file a claim with your insurance company. As long as you have a valid policy in place, you should be able to file a claim as needed.

11. Can EBT card holders get roadside assistance through their car insurance?

Many insurance companies offer roadside assistance as an optional add-on to your policy. EBT card holders can choose to add this coverage if they wish.

12. Will my EBT benefits be affected if I receive a settlement from a car insurance claim?

Receiving a settlement from a car insurance claim should not affect your EBT benefits. Insurance payouts are typically not considered income for the purposes of EBT eligibility.

13. Can EBT card holders switch car insurance providers easily?

Switching car insurance providers is typically a straightforward process, regardless of whether you are an EBT card holder or not. It is important to compare rates and coverage options before making a switch.

Insight from Professionals:

– “EBT card holders should not face any obstacles when it comes to obtaining car insurance. It is important to shop around and compare rates to find the best coverage for your needs.” – Insurance Agent

– “Insurance companies do not discriminate against EBT card holders. As long as you meet the eligibility requirements, you should be able to purchase car insurance like any other driver.” – Insurance Underwriter

– “Low-income individuals, including EBT card holders, may qualify for discounts or assistance programs offered by insurance companies or state agencies. It is worth exploring these options to save money on car insurance.” – Claims Adjuster

– “Having an EBT card should not hinder your ability to file a claim with your insurance company. As long as you have a valid policy in place, you should be able to receive coverage for any damages or losses.” – Insurance Adjuster

Customer Complaints and Positive Reviews:

State Farm:

Complaints:

1. “State Farm’s rates are too high for EBT card holders like me.”

2. “I had a difficult time reaching customer service for assistance with my policy.”

3. “I was denied coverage by State Farm because of my EBT card status.”

Positive Reviews:

1. “State Farm offers excellent customer service and a variety of coverage options.”

2. “I have been a State Farm customer for years and have always been satisfied with their service.”

3. “State Farm is a reputable insurance carrier with a strong presence in my city.”

Progressive:

Complaints:

1. “Progressive’s claims process was lengthy and frustrating.”

2. “I had issues with Progressive’s billing system and payment options.”

3. “I did not receive the discounts I was promised as an EBT card holder.”

Positive Reviews:

1. “Progressive offers competitive rates and a user-friendly website for managing policies.”

2. “I appreciate Progressive’s willingness to work with low-income individuals like me.”

3. “I have had a positive experience with Progressive’s customer service team.”

GEICO:

Complaints:

1. “GEICO’s rates increased significantly after I disclosed my EBT card status.”

2. “I encountered difficulties when filing a claim with GEICO.”

3. “GEICO’s policies were confusing and hard to understand.”

Positive Reviews:

1. “GEICO offers affordable rates and a variety of coverage options for EBT card holders.”

2. “I have had a positive experience with GEICO’s claims process and customer service.”

3. “GEICO is a trusted insurance carrier with a strong reputation in my state.”

Allstate:

Complaints:

1. “Allstate’s rates were too high for my budget as an EBT card holder.”

2. “I experienced delays in receiving assistance from Allstate’s claims department.”

3. “I was denied coverage by Allstate because of my EBT card status.”

Positive Reviews:

1. “Allstate provides comprehensive coverage options and excellent customer service.”

2. “I have been a satisfied Allstate customer for many years.”

3. “Allstate is a reliable insurance carrier with a strong presence in my city.”

USAA:

Complaints:

1. “USAA’s eligibility requirements were too strict for EBT card holders.”

2. “I had difficulties accessing USAA’s online account management system.”

3. “USAA’s rates were not competitive for low-income individuals like me.”

Positive Reviews:

1. “USAA offers excellent customer service and a range of discounts for military members.”

2. “I appreciate USAA’s commitment to serving military families and low-income individuals.”

3. “I have had a positive experience with USAA’s claims process and coverage options.”

In summary, EBT card holders are eligible for car insurance and should not face any obstacles when it comes to obtaining coverage. It is important to compare rates, coverage options, and discounts offered by different insurance providers to find the best policy for your needs. By exploring all available options and seeking assistance from professionals in the field, EBT card holders can secure the car insurance coverage they need to stay protected on the road. Remember to consider customer reviews and complaints when choosing an insurance carrier near you to ensure you receive the best service possible.