As a licensed insurance agent serving drivers across Alabama, I’ve had dozens of conversations with clients who are one unexpected bill away from letting their car insurance lapse.

“My power bill went up, my hours got cut, and now I can’t afford this month’s insurance.”

If you’re in that situation — first, you’re not alone. And second, you do have options. Car insurance in Alabama is required by law, but that doesn’t mean you have to choose between keeping your vehicle and paying the rent.

There are resources — both government-related and charitable — that may help cover your car insurance in a financial emergency. This article walks you through the exact steps I guide my clients through when they’re in a bind.

🚗 Understanding Alabama’s Insurance Requirements

If your vehicle is registered in Alabama, you must carry:

- $25,000 for bodily injury per person

- $50,000 for bodily injury per accident

- $25,000 for property damage

Failing to maintain coverage can lead to:

- A $200 to $400 fine for the first offense

- Vehicle registration suspension

- Reinstatement fees and proof of coverage filing (SR-22)

- Higher premiums for years

So even if you’re temporarily unable to pay your premium, don’t let your policy cancel without exploring assistance.

📞 Alabama’s Emergency Assistance and Referral Resources

There’s no statewide program that directly pays for car insurance, but Alabama does offer several regional and local services that can help depending on your situation.

1. Alabama 2-1-1 Connects

Dial 2-1-1 or visit 211connectsalabama.org to find:

- Local nonprofits that help with transportation

- Churches and faith-based ministries offering bill assistance

- Emergency financial relief based on ZIP code

Many clients I’ve helped have found success by calling 2-1-1 first — especially if the need is tied to employment, school, or healthcare access.

❤️ Nonprofits and Community Organizations in Alabama

You might not find a charity that openly says “we pay car insurance,” but if you explain your situation, many will consider it — especially if your car is your lifeline to work or childcare.

2. Catholic Social Services – Diocese of Birmingham and Mobile

Services may include:

- One-time financial aid

- Car insurance payments for verified hardship cases

- Assistance tied to employment or safety

Call your nearest regional office and ask about transportation-related emergency assistance.

3. The Salvation Army – Alabama Locations

Active in major cities like Montgomery, Birmingham, Huntsville, and Tuscaloosa. They provide:

- Emergency financial aid

- Utility and vehicle-related assistance

- Case management for families facing hardship

Your car insurance premium may be covered if your job, medical appointments, or safety depend on having a working, insured vehicle.

4. Society of St. Vincent de Paul (Local Conferences)

This Catholic lay organization offers:

- One-time car insurance payments

- Help with transportation for job seekers or single parents

- Fast response for urgent needs (if funding is available)

Contact your local parish to find out which SVdP chapter serves your ZIP code.

5. Community Action Agencies (CAAs) Across Alabama

Each county has a CAA that may provide:

- Short-term assistance

- Financial coaching

- Emergency relief tied to employment transportation

Visit the Alabama Community Action Association site to find your local office.

🧾 What You’ll Need to Apply for Help

Whether you’re requesting aid from a nonprofit or a county resource center, gather the following ahead of time:

| Document | Purpose |

|---|---|

| Driver’s License | Confirms your identity |

| Insurance Bill / Cancellation Notice | Proves urgency |

| Vehicle Registration | Confirms legal ownership |

| Pay stubs or bank statements | Shows hardship |

| Brief written explanation | Clarifies why you need help |

🧠 Pro Tip: Keep your paperwork simple, and always explain how lack of insurance will directly impact your life or work. That’s what many caseworkers prioritize.

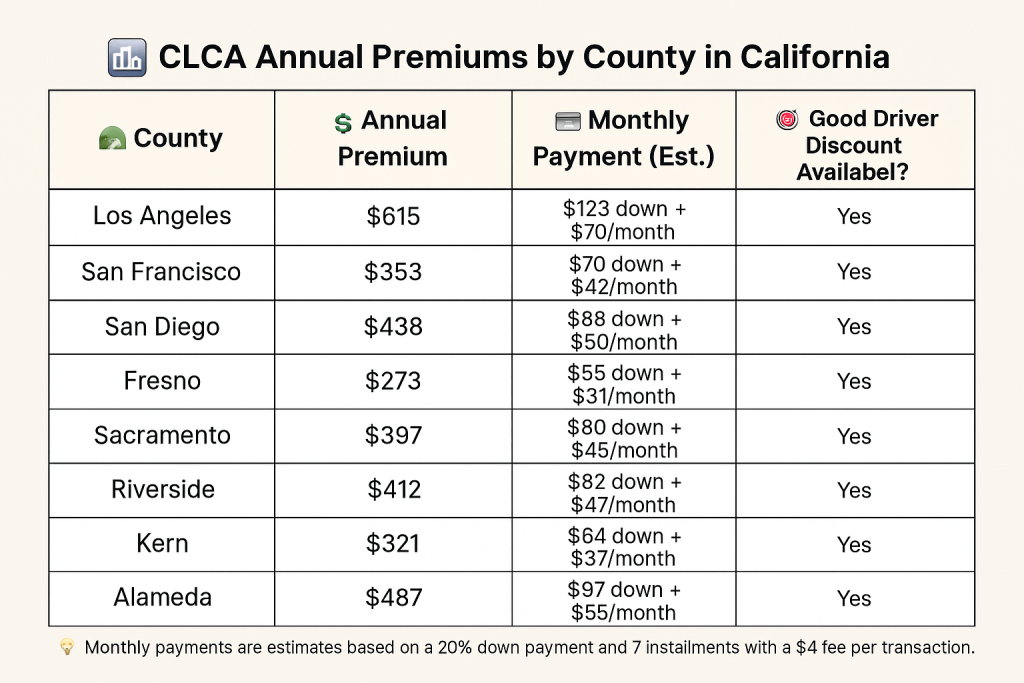

🏙️ Average Car Insurance Rates in Alabama (Liability-Only)

Rates vary by location, driving record, and insurer. Here’s a general idea of what liability-only coverage may cost in 10 Alabama cities:

| City | Avg Monthly Rate |

|---|---|

| Birmingham | $122 |

| Montgomery | $117 |

| Mobile | $120 |

| Huntsville | $110 |

| Tuscaloosa | $114 |

| Dothan | $108 |

| Decatur | $106 |

| Auburn | $112 |

| Gadsden | $119 |

| Florence | $104 |

If your rate is far above average and you haven’t had recent violations, ask your agent to shop around — or consider switching to a usage-based or independent carrier.

✅ 10 Cost-Saving Tips I Share With Alabama Clients in Crisis

When someone tells me they’re close to cancellation, here’s exactly what I recommend:

- Call your insurer and ask for a short-term grace period or extension

- Drop full coverage on older vehicles (liability may be enough)

- Raise your deductible to reduce monthly cost

- Remove non-driving household members from your policy

- Apply for multi-policy or multi-vehicle discounts

- Take a certified defensive driving course (some carriers offer instant discounts)

- Consider pay-per-mile insurance like Hugo or Root if you drive infrequently

- Shop other carriers — don’t assume your current one is cheapest

- Bundle renters/home insurance to get up to 15% off

- Temporarily pause non-essential add-ons like rental car or roadside coverage

Even 2–3 of these steps can shave $20–$60 off your monthly premium.

📞 How to Ask for Help (Even If You’re Nervous)

You don’t need to beg or feel ashamed. Most caseworkers and nonprofits are used to receiving calls like yours — just be clear and honest:

“Hi, I’m currently facing financial hardship and I’m about to lose my car insurance. I use my car to get to work and take care of my family. Do you offer any transportation-related assistance, or can you point me to someone who does?”

If they say no, follow up with:

“Do you know another organization in the area that might be able to help?”

🧡 Final Thoughts From a Local Insurance Agent

Life hits hard sometimes — and in Alabama, where public transportation is limited, losing your car can mean losing everything.

But you’re not out of options. Whether you reach out to a local nonprofit, restructure your current policy, or call 2-1-1, the key is to act before your coverage lapses.

As someone who works in this space every day, I’ve seen people stay on the road — and even lower their monthly cost — just by asking the right questions, being honest about their situation, and reaching out to the right people.

You’ve got this. One phone call or one quote could make the difference between keeping your car and losing your freedom.